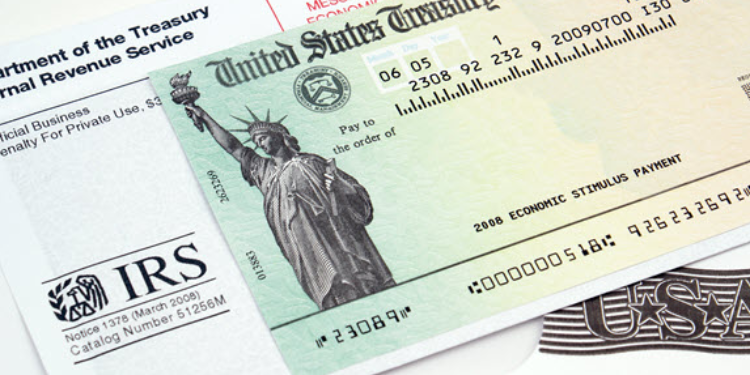

What is the COVID-19 Stimulus Check / Economic Impact Payment?

Economic Impact Payment, better known as Stimulus Check, is a direct payment to American families that the U.S. government provided in response to COVID-19. Three checks were paid from April 2020 to December 2021:

- The first check provided up to $1,200 per eligible adult and $500 per eligible dependent child

- The second stimulus check offered up to $600 per eligible adult and dependent child

- The third stimulus check of up to $1,400 was made available per adult and dependent (there is no age requirement; the dependent can be any age)

The deadline to claim a refund on a 2020 tax return is June 15, 2024. As such, the time is now to request it!

You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third.

Depending on your filing status and income (the full amount is given if your income us less than 75,000 USD), you may be eligible to receive up to $3,200.

You would even receive more if you have dependents.

Who can claim Stimulus Checks?

- US tax resident - US citizenship – You must be a U.S. citizen, green card holder, or eligible resident alien (‘substantial presence test'). People considering renouncing their US citizenship can also apply for stimulus checks. This includes those who will no longer be US citizens in later years.

- Social Security Number – A person must have a Social Security Number (SSN) to receive the stimulus check. Therefore, an individual with an individual taxpayer identification number (ITIN) will not receive these checks. Additionally, if the social security number card has the words “NOT VALID FOR WORK,” the person would not be eligible.

- Dependency – The amount of money you are entitled to may be further increased if you have children or adults in your care. If you claim dependents for the 3rd stimulus check, they can be any age if they have an SSN or ATIN. Additionally, you cannot be considered dependent on someone else on a tax return to get the third stimulus check for yourself.

- Income – Households with adjusted gross income (AGI) up to $75,000 for individuals (or married couples filing separately) will receive the full payment. For those who declare that they are head of household, the threshold is $112,500; for those who report being married jointly, the threshold is $150,000. Although there is no minimum income requirement to qualify for stimulus checks, the payment amount gradually decreases for people with higher incomes. Those whose adjusted gross income in excess of 75,000 USD will receive a reduced amount.

The importance of compliance

Why should you get into compliance? Compliance ensures that you are in good standing with the IRS and are eligible for all financial assistance programs the U.S. government offers. Being compliant does not mean you will have to pay any penalties, and in many cases, neither. In most cases, you won't even have to pay any taxes to the IRS.

How do you claim your stimulus check?

Here are the basic steps to apply for a Recovery Rebate Credit:

- File your 2020 and 2021 tax returns: If you have not yet filed, it is imperative that you do so now.

- Claim a tax refund credit: You will find the Recovery rebate credit on line 30 of your 2020 and 2021 tax returns.

- Understand the deadline: Due to the three-year statute of limitations for filing tax refund claims, the last opportunity to file these returns and claim your stimulus checks is quickly approaching: the deadline is June 15, 2024, so it is imperative to act now.

- Gather necessary documentation: To file these reports, you will need all 2020 and 2021 income statements and other relevant financial documents.

- Submit your taxes: File your 2020 and 2021 tax returns with your tax refund credit included. If you are unsure how to proceed, seek help from a tax professional specializing in foreign tax matters.

- Track your refund: After submitting your request, you can track the status of your refund through the “Where's My Refund?” page on the IRS website. This will tell you when to expect your stimulus payment.

Related: Don't Miss Out! A Guide to Recovery Rebate Credit for U.S. Expats

If you have questions or need personalized advice about your tax situation, 1040 Abroad is here to help. We offer free tax advice to US expats to ensure you are fully informed and compliant with your tax obligations. Contact us for expert advice tailored to your unique needs as an American expat.